Life Insurance in and around Matthews

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

Buying life insurance coverage can be a lot to consider with a variety of options out there, but with State Farm, you can be sure to receive dependable reliable service. State Farm understands that your goal is to protect your loved ones.

Insurance that helps life's moments move on

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the worst comes to pass, Jessica Ross stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

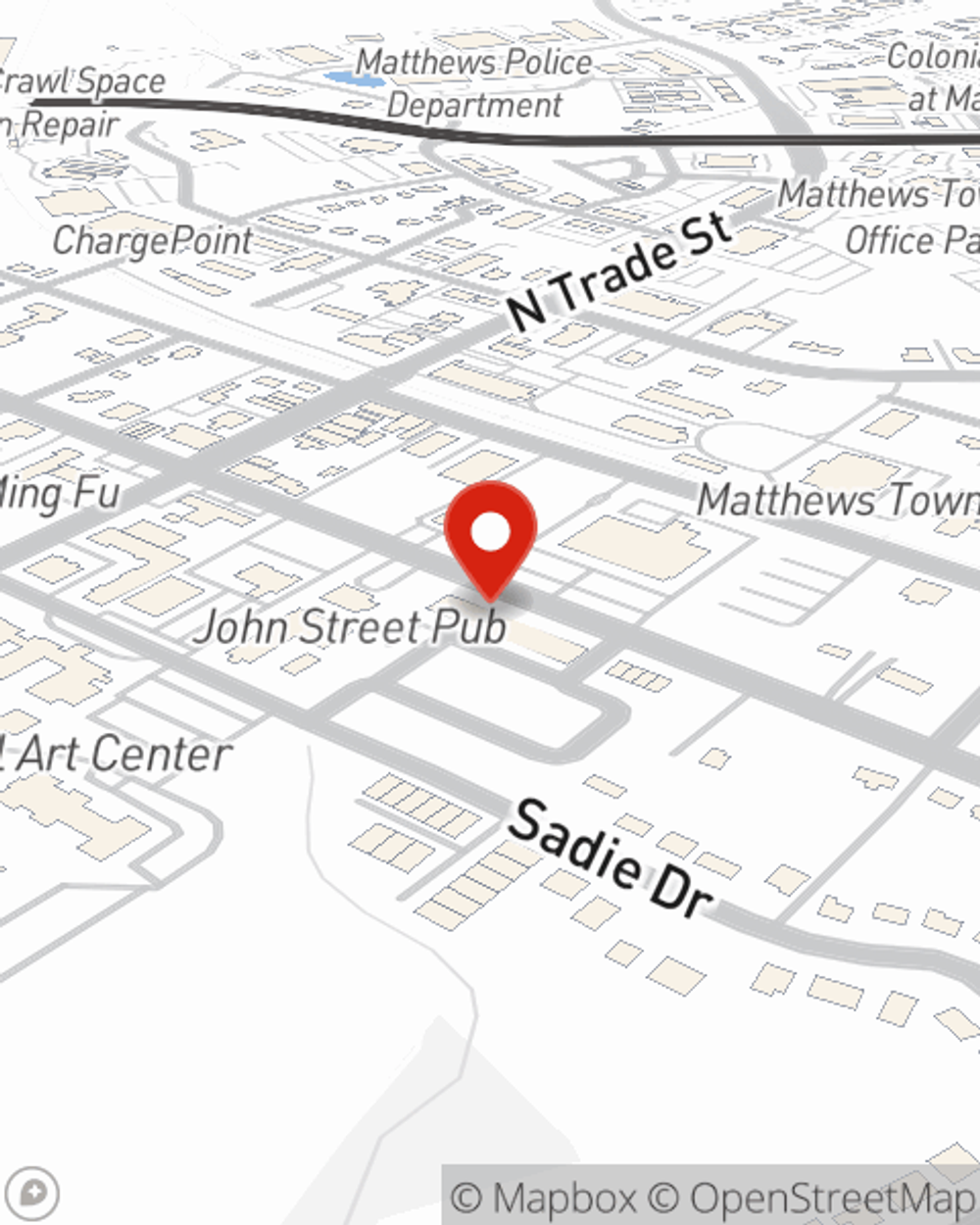

Get in touch with State Farm Agent Jessica Ross today to find out how a State Farm policy can ease your worries about the future here in Matthews, NC.

Have More Questions About Life Insurance?

Call Jessica at (704) 544-3205 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Jessica Ross

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.